Reasons to Keep Business in Philadelphia

Choosing a location for your business is a big decision. Not only do you have to have a successful business model but also the staff to support your endeavors. Often times when working with clients looking to lease or purchase office space we discuss more than just the building requirements. Access to transportation, vibrant communities and many other factors that impact employee happiness.

As a Philadelphia Commercial Real Estate Broker & Tenant Rep. we LOVE Philadelphia. The History, People, Culture, Charm and the character of each of the towns that make up the vast Philadelphia Suburbs.

Here are a few Fall Events that happen in September that are a few reasons our clients and their employees love to live and work in the Greater Philadelphia area.

- Scarecrow Festival in Peddler’s Village in Bucks County

- Kennett Square Mushroom Festival in Chester County

- The Franklin Institute in Philadelphia County – Catch the Lego Exhibit before October!

- Made in America Festival in Philadelphia

- Garden Railway, & Stickworks and other Fall Events and Activities at the Morris Arboretum (University of Pennsylvania & the Commonwealth of PA’s official arboretum)

Posted in: Philadelphia

Leave a Comment: (0) →

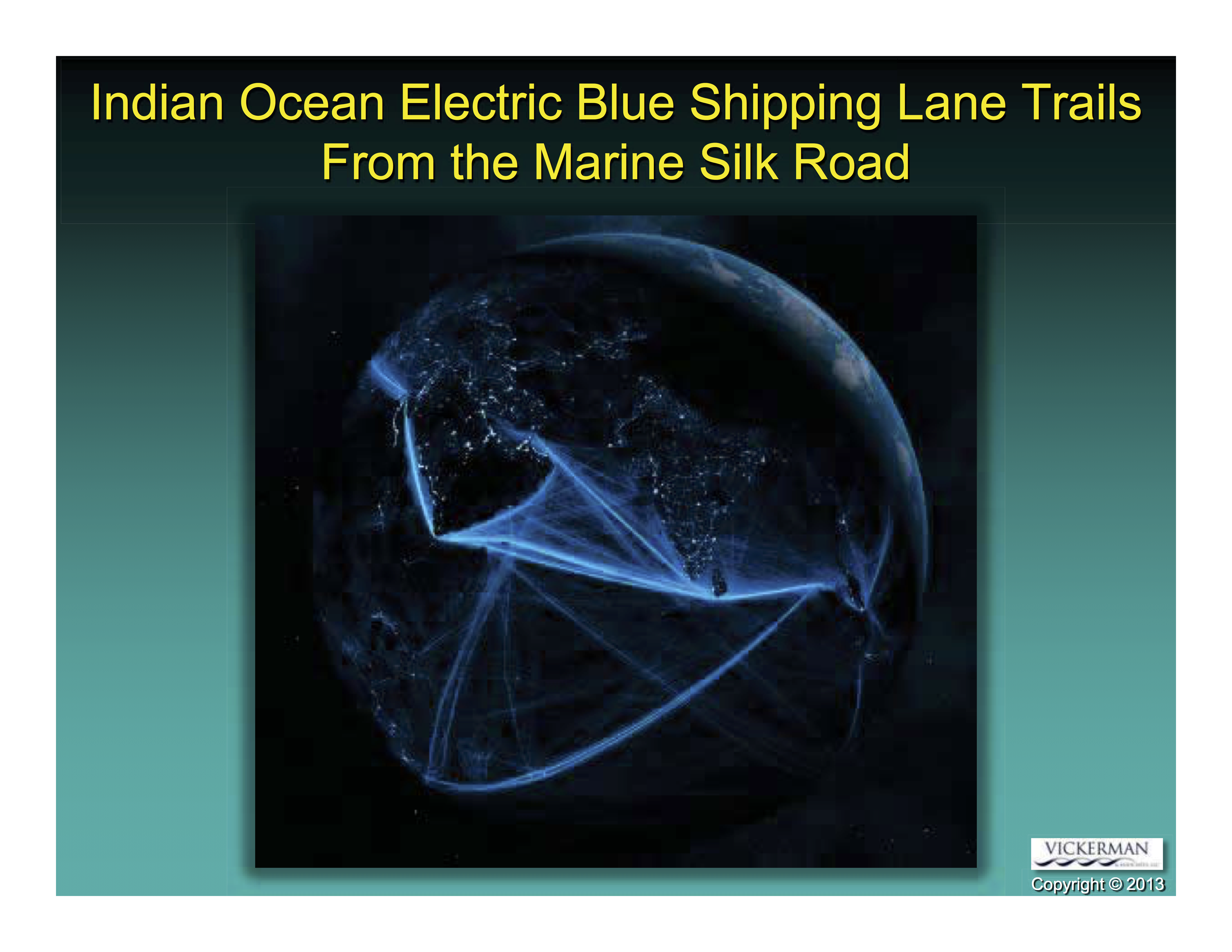

Is there a relationship between Suez & Panama Canals, Philadelphia Region, and demand for Commercial Real Estate?

Is there a relationship between Suez & Panama Canals, Philadelphia Region, and demand for Commercial Real Estate?